Introduction

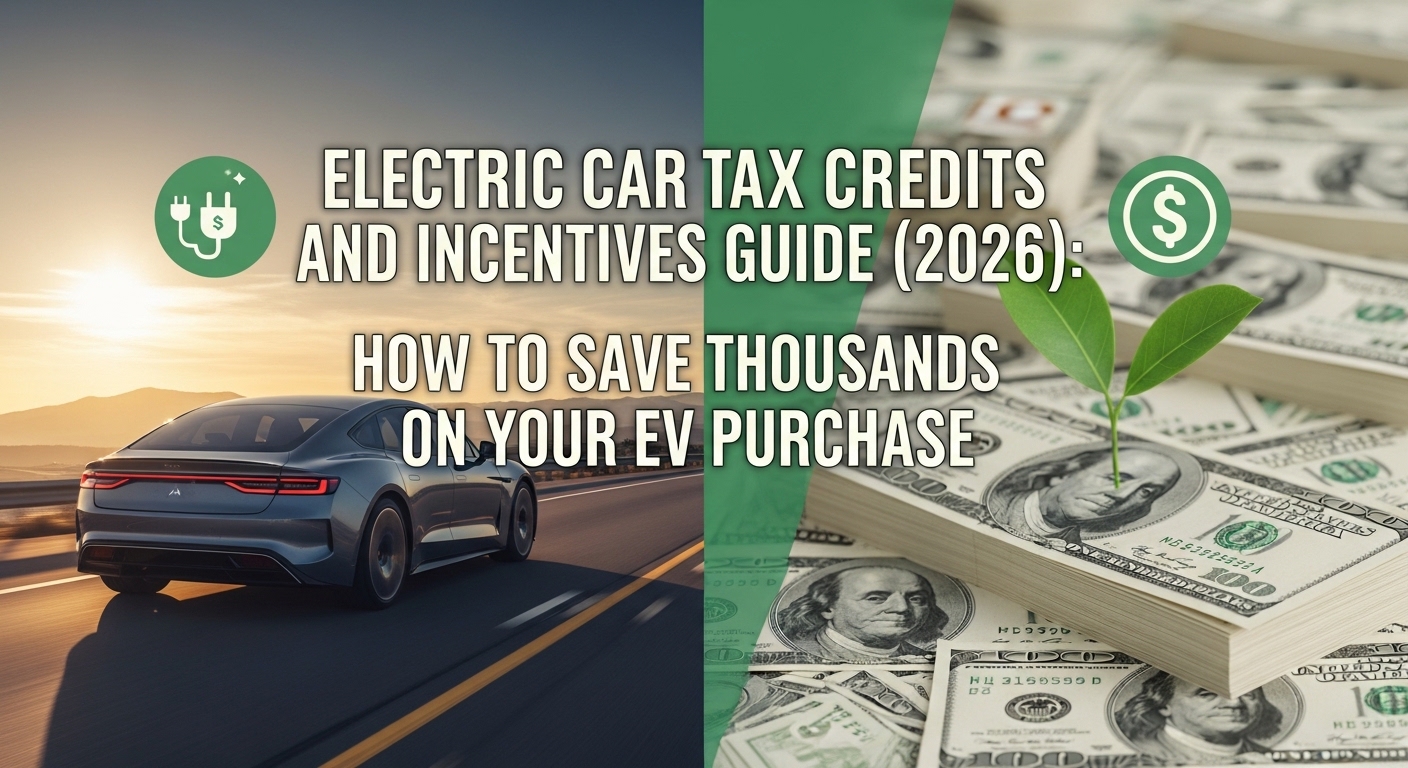

Buying an electric vehicle (EV) is no longer just about reducing emissions — it’s also about saving money. With federal EV tax credits, state rebates, and local electric vehicle incentives, you could lower your upfront cost by thousands of dollars.

But here’s the problem: the rules can feel confusing. Income limits, battery requirements, vehicle eligibility, point-of-sale credits — it’s easy to miss out on savings if you don’t understand how everything works.

In this complete Electric Car Tax Credits and Incentives Guide, you’ll learn:

-

How the federal EV tax credit works

-

Who qualifies (and who doesn’t)

-

State and local EV rebate programs

-

How to claim your electric vehicle tax incentive correctly

-

Smart strategies to maximize savings

Let’s break it down in simple, practical terms.

What Are Electric Car Tax Credits and Incentives?

Electric car incentives are financial benefits offered by governments or utilities to encourage people to buy electric vehicles.

These incentives can include:

-

Federal EV tax credits

-

State electric vehicle rebates

-

Clean vehicle grants

-

EV charger installation rebates

-

Utility company incentives

-

Reduced registration fees or toll discounts

The goal is simple: make EV ownership more affordable while promoting clean energy adoption.

How the Federal EV Tax Credit Works (2026 Update)

The federal electric vehicle tax credit is one of the most valuable savings opportunities for EV buyers.

Key Highlights:

-

Credit worth up to $7,500

-

Applies to qualifying new electric vehicles

-

Income limits apply

-

Vehicle price caps apply

-

Battery sourcing requirements must be met

Income Limits (Modified Adjusted Gross Income)

You may qualify if your income is below:

-

$150,000 (single filer)

-

$225,000 (head of household)

-

$300,000 (married filing jointly)

If your income exceeds these limits, you won’t qualify for the federal EV incentive.

Vehicle Price Caps

To prevent luxury-only benefits, the government sets MSRP limits:

-

$55,000 cap for sedans

-

$80,000 cap for SUVs, trucks, and vans

If the vehicle price exceeds the cap, it won’t qualify for the clean vehicle credit.

Battery and Manufacturing Requirements

To qualify for the full $7,500:

-

A percentage of battery materials must be sourced from approved countries

-

Vehicle assembly must occur in North America

Some vehicles may qualify for $3,750 instead of the full amount if they meet only partial requirements.

Point-of-Sale EV Tax Credit (Instant Savings)

One major improvement in recent years is the point-of-sale transfer option.

Instead of waiting until tax season, you can now:

-

Transfer the credit to the dealer

-

Receive the discount immediately at purchase

This lowers your upfront vehicle cost — making electric cars more accessible.

Used Electric Vehicle Tax Credit

You can also qualify for a used EV tax credit worth up to:

-

$4,000

-

Or 30% of the vehicle price (whichever is lower)

Requirements:

-

Vehicle must cost under $25,000

-

Must be at least two model years old

-

Purchased from a licensed dealer

-

Income limits are lower than new EV credits

This makes affordable electric vehicles even more attractive for budget-conscious buyers.

State Electric Vehicle Incentives (Extra Savings)

In addition to federal credits, many states offer EV rebates and clean energy incentives.

Examples of common state-level incentives:

-

Cash rebates ($1,000–$5,000)

-

Sales tax exemptions

-

Reduced registration fees

-

HOV lane access

-

EV charger rebates

Because programs change often, it’s important to check your state’s official energy or transportation website.

Stacking federal + state incentives can result in $10,000 or more in total savings in some regions.

Utility Company EV Rebates

Many electric utility providers offer:

-

Home EV charger installation rebates

-

Time-of-use charging discounts

-

Bill credits for off-peak charging

-

Special EV electricity rates

These incentives reduce long-term charging costs and improve EV affordability.

How to Claim the Federal EV Tax Credit

Here’s a step-by-step breakdown:

1. Confirm Vehicle Eligibility

Check:

-

MSRP cap

-

Assembly location

-

Battery sourcing requirements

2. Verify Your Income

Make sure your modified adjusted gross income falls below limits.

3. Choose Point-of-Sale or Tax Filing

You can:

-

Claim at purchase (instant discount), or

-

Claim when filing your federal taxes

4. File the Required IRS Form

If claiming during tax season, include the proper clean vehicle credit form with your return.

High-Value Keywords Naturally Included

Throughout this guide, we’ve covered important high-CPC search terms such as:

-

electric vehicle tax credit 2026

-

federal EV incentive

-

clean vehicle credit eligibility

-

EV rebate programs

-

electric car government incentives

-

EV charger tax credit

-

used EV tax credit

These are commonly searched terms by buyers actively considering a purchase.

Can You Combine Multiple Incentives?

Yes — and this is where major savings happen.

You may combine:

-

Federal EV tax credit

-

State rebate

-

Utility incentive

-

EV charger tax credit

-

Local clean transportation grants

However, always verify that stacking is allowed in your state.

EV Charger Tax Credit (Home Charging Savings)

Don’t forget about charging equipment incentives.

You may qualify for:

-

30% tax credit on home charger installation

-

Maximum credit varies by program

This reduces the cost of installing a Level 2 home charging station.

Common Mistakes to Avoid

Here are errors that cost buyers thousands:

-

Buying a vehicle above MSRP cap

-

Exceeding income limits

-

Not confirming assembly location

-

Missing state rebate deadlines

-

Forgetting charger incentives

Always verify eligibility before signing paperwork.

Are Electric Car Incentives Worth It?

Absolutely — but only if you qualify.

With:

-

$7,500 federal credit

-

$4,000 used EV credit

-

$1,000–$5,000 state rebates

-

Charger installation credits

The total savings can dramatically reduce the real cost of EV ownership.

In many cases, an electric vehicle becomes comparable in price to a gasoline car after incentives — especially when factoring in lower fuel and maintenance costs.

The Future of EV Tax Credits

Government incentives evolve frequently. Policies may:

-

Expand to new vehicle models

-

Adjust income limits

-

Change battery sourcing rules

-

Increase or decrease credit amounts

Staying informed ensures you maximize available benefits before changes occur.

Take Advantage Before Incentives Change

Electric car tax credits and incentives can save you thousands — but only if you understand the rules and act strategically.

Before buying:

-

Confirm eligibility

-

Check federal + state programs

-

Review income limits

-

Ask the dealer about point-of-sale credits

-

Apply for charger rebates

If you’re considering going electric, now is the time to research your options and secure every incentive available.

Have questions about qualifying for EV incentives? Drop a comment and let’s discuss your situation.

Frequently Asked Questions (FAQ)

1. How much is the federal electric vehicle tax credit in 2026?

The maximum credit is up to $7,500 for qualifying new EVs, depending on battery and sourcing requirements.

2. Can I get a tax credit for a used electric car?

Yes. You may qualify for up to $4,000 if the vehicle meets eligibility rules and income limits.

3. Do EV tax credits reduce my taxable income?

No. They reduce your tax liability directly, meaning they lower the amount of tax you owe.

4. Can I combine federal and state EV incentives?

In most cases, yes. Many buyers stack federal, state, and utility incentives for maximum savings.

5. Is there a tax credit for installing a home EV charger?

Yes. Many homeowners qualify for a 30% EV charger installation tax credit, depending on location and program availability.