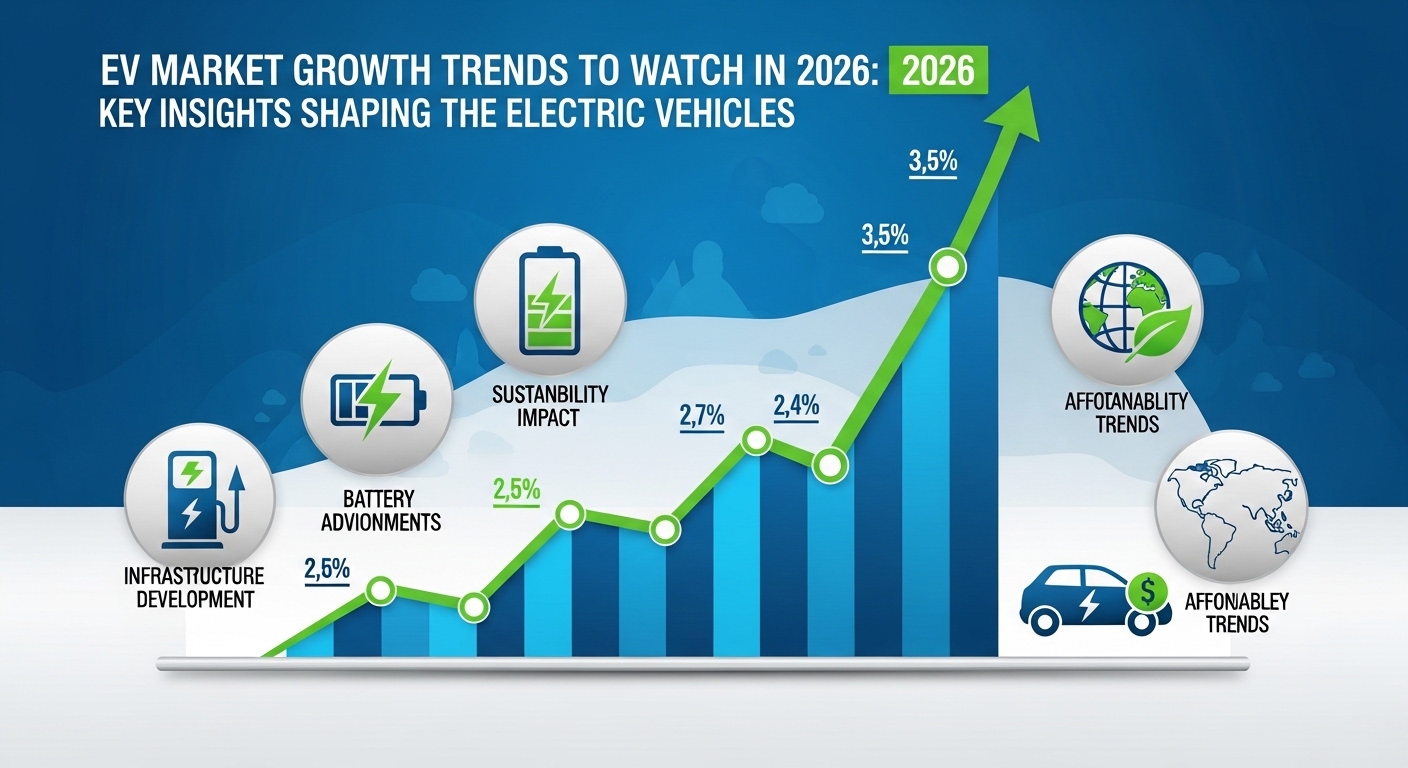

The global electric vehicle (EV) market is entering a critical growth phase. As we move toward 2026, electric cars are no longer just an eco-friendly alternative—they are becoming a mainstream transportation choice. Governments, manufacturers, and consumers are all pushing the market forward at an unprecedented pace.

In this article, we’ll explore the most important EV market growth trends to watch in 2026, explained in simple, practical terms. Whether you’re an investor, a tech enthusiast, or someone planning to buy an electric car, these insights will help you understand where the EV industry is heading and why it matters.

The Global EV Market Outlook for 2026

The electric vehicle market is expected to see steady and sustainable growth by 2026. Rising fuel costs, stricter emissions regulations, and rapid improvements in EV technology are driving demand worldwide.

Key factors shaping EV market growth include:

- Increased government incentives for electric vehicles

- Expansion of EV charging infrastructure

- Falling battery production costs

- Growing consumer trust in electric mobility

These elements together are transforming electric vehicles from a niche product into a global standard.

Rising Demand for Affordable Electric Vehicles

Why affordability is driving EV adoption

One of the strongest EV market growth trends in 2026 is the rise of affordable electric vehicles. Manufacturers are focusing on budget-friendly EV models designed for mass adoption.

Lower production costs and improved supply chains are helping reduce vehicle prices, making EVs more accessible to average consumers.

Key benefits of affordable EVs

- Lower total cost of ownership

- Reduced maintenance expenses

- Competitive pricing compared to gas-powered cars

- Better resale value over time

As affordability improves, EV adoption rates are expected to surge in both developed and emerging markets.

Battery Technology Advancements Reshaping the Market

Next-generation EV batteries

Battery innovation is at the core of EV market growth. By 2026, advanced battery technologies are expected to deliver:

- Longer driving ranges

- Faster charging times

- Improved safety and durability

Solid-state batteries and enhanced lithium-ion designs are gaining attention for their efficiency and reliability.

Impact on EV buyers

Better batteries mean:

- Less range anxiety

- Shorter charging stops

- Longer battery life

These improvements significantly boost consumer confidence and accelerate EV market expansion.

Expansion of EV Charging Infrastructure

Public and private charging growth

Another major EV market growth trend to watch in 2026 is the rapid expansion of EV charging stations. Governments and private companies are investing heavily in charging networks.

Charging infrastructure is improving in:

- Urban centers

- Highways and travel routes

- Residential and commercial buildings

Smart charging solutions

New smart charging technologies allow users to:

- Monitor charging remotely

- Optimize energy usage

- Reduce electricity costs

A reliable charging ecosystem removes one of the biggest barriers to EV adoption.

Government Policies and Incentives Fueling EV Growth

Supportive regulations worldwide

Government policies continue to play a crucial role in EV market growth. Many countries are setting clear targets to phase out internal combustion engines.

Common government incentives include:

- EV tax credits and rebates

- Reduced registration fees

- Free or discounted charging access

- Priority lanes and parking benefits

Long-term market impact

Supportive policies encourage manufacturers to invest in EV innovation while giving consumers financial confidence to switch to electric vehicles.

Increased Investment in EV Manufacturing and Supply Chains

Global EV investments on the rise

By 2026, investment in EV production facilities and supply chains is expected to reach new highs. Automakers are expanding factories and securing battery material sources.

Key investment areas include:

- Battery manufacturing plants

- EV software development

- Recycling and sustainable materials

Why this matters

Strong supply chains reduce production delays, stabilize prices, and ensure long-term EV market sustainability.

Commercial and Fleet EV Adoption Accelerates

Growth of electric fleets

Electric vehicles are becoming popular in commercial fleets, delivery services, and public transportation. Businesses are adopting EVs to reduce fuel costs and meet sustainability goals.

Fleet EV benefits include:

- Lower operating costs

- Predictable maintenance expenses

- Reduced carbon footprint

Market influence

Fleet adoption increases EV production volume, which further lowers costs for individual consumers and supports overall market growth.

Software and Connectivity Transforming EVs

Smart EV features

By 2026, EVs will be more connected than ever. Software-driven features such as over-the-air updates, advanced driver assistance, and energy management tools are becoming standard.

Popular EV software features include:

- Real-time vehicle diagnostics

- Battery health monitoring

- Route planning with charging optimization

Competitive advantage

Connected EVs improve user experience and strengthen brand trust, contributing to sustained market growth.

Sustainability and EV Recycling Trends

Focus on circular economy

Sustainability is a growing priority in the EV market. Manufacturers are investing in battery recycling and eco-friendly materials to reduce environmental impact.

Key sustainability efforts include:

- Battery reuse and recycling programs

- Reduced reliance on rare materials

- Cleaner production processes

These practices help address environmental concerns and improve the long-term image of electric vehicles.

Challenges That Could Impact EV Market Growth

Despite strong momentum, the EV market still faces challenges:

- Limited charging access in rural areas

- Battery raw material supply constraints

- Grid capacity and energy demand issues

However, ongoing innovation and infrastructure investment are expected to gradually resolve these issues by 2026.

Conclusion

The EV market growth trends to watch in 2026 point toward a future where electric vehicles become the norm rather than the exception. Affordable pricing, better batteries, expanded charging infrastructure, and supportive government policies are all driving rapid adoption.

As technology continues to evolve, EVs will offer better performance, lower costs, and greater convenience. If you’re considering entering the EV market—whether as a buyer, investor, or business—now is the time to stay informed and prepare for the shift.

Feel free to share your thoughts or questions in the comments and join the conversation about the future of electric mobility.

Frequently Asked Questions (FAQ)

1. Will electric vehicles become cheaper by 2026?

Yes, lower battery costs and increased production efficiency are expected to make EVs more affordable by 2026.

2. What is the biggest driver of EV market growth?

Government incentives, improved battery technology, and expanding charging infrastructure are the biggest growth drivers.

3. Are EV charging stations expanding fast enough?

Charging infrastructure is growing rapidly, especially in cities and major highways, with continued expansion planned.

4. Will EV batteries last longer in the future?

Yes, new battery technologies are improving lifespan, efficiency, and safety.

5. Is investing in the EV market a good idea?

Many analysts see long-term potential in the EV sector due to strong demand and global policy support.