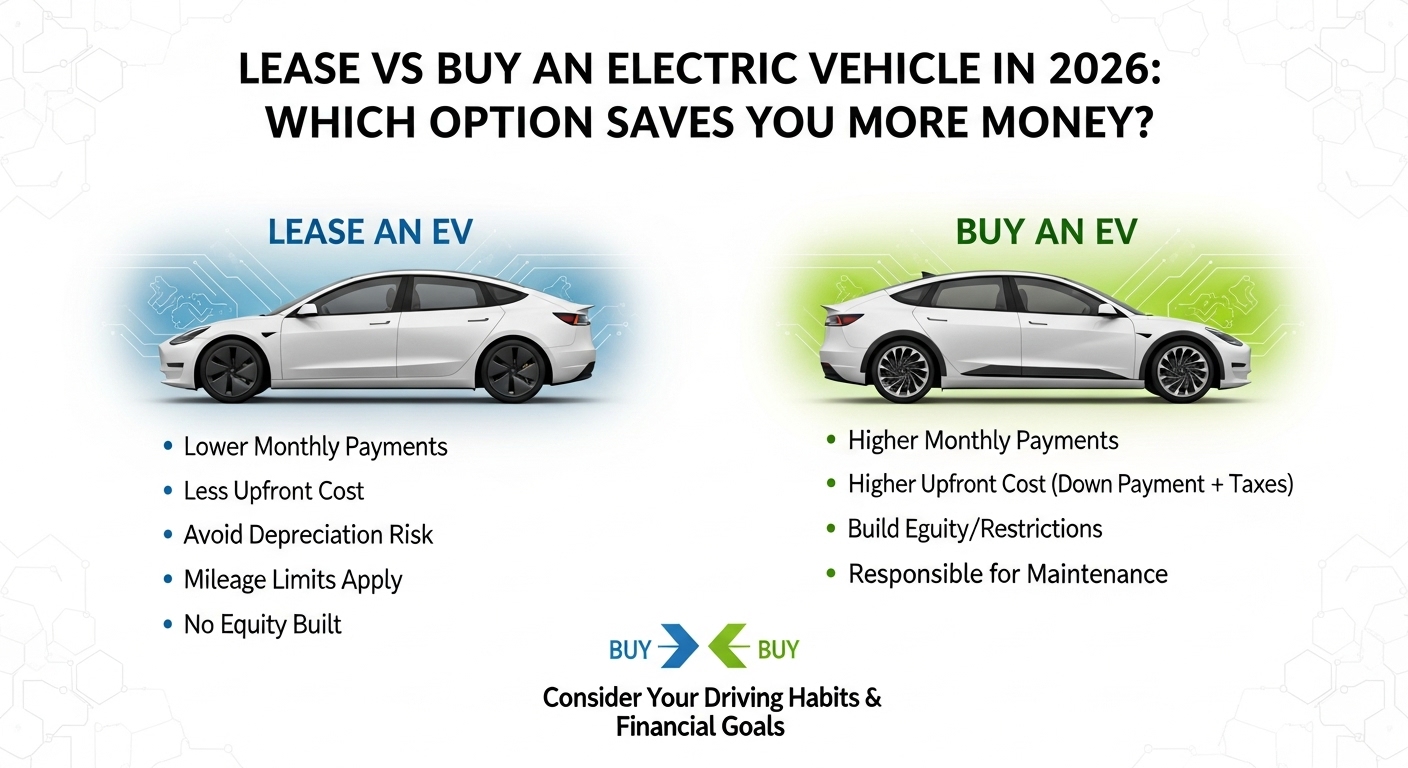

Lease vs Buy an Electric Vehicle in 2026: Which Option Saves You More Money?

Introduction

Electric vehicles (EVs) are more popular than ever in 2026, offering cleaner transportation, lower running costs, and innovative technology. If you’re considering an EV, one of the biggest decisions you’ll face is whether to lease or buy. Both options have unique benefits, costs, and financial implications. This article breaks down the differences, helping you make a smart choice for your budget and lifestyle.

Understanding the Basics: Leasing vs Buying an EV

What Does It Mean to Lease an Electric Vehicle?

Leasing an EV is like renting it for a fixed period, typically 2-4 years. You make monthly payments but do not own the vehicle at the end of the term.

Key Points of Leasing:

-

Lower monthly payments compared to buying

-

Ability to drive a new model every few years

-

Fewer maintenance responsibilities

-

Mileage limits may apply

What Does It Mean to Buy an Electric Vehicle?

Buying an EV means you own it outright, either by paying cash or financing through a loan. You can keep it as long as you want.

Key Benefits of Buying:

-

Full ownership of the vehicle

-

No mileage restrictions

-

Potential long-term savings after loan payoff

-

Can customize your EV freely

Cost Comparison: Lease vs Buy

Upfront Costs

-

Leasing: Usually lower down payment and lower taxes

-

Buying: Higher down payment, but you start building equity

Monthly Payments

-

Leasing: Monthly payments are generally 20-40% lower

-

Buying: Payments may be higher but contribute to ownership

Long-Term Value

-

Leasing: No resale concerns, but you never build equity

-

Buying: EVs hold value differently; resale or trade-in can offset costs

Advantages and Disadvantages

Leasing Pros and Cons

Pros:

-

Drive the latest EV models

-

Predictable monthly costs

-

Warranty often covers most repairs

Cons:

-

Limited mileage

-

No ownership equity

-

Extra fees for wear and tear

Buying Pros and Cons

Pros:

-

Complete ownership

-

Freedom to drive unlimited miles

-

Long-term cost savings

Cons:

-

Higher monthly payments

-

Depreciation risk

-

Responsible for repairs after warranty

Factors to Consider Before Deciding

-

Driving habits: Frequent long-distance driving may favor buying

-

Budget flexibility: Leasing may be easier for tight budgets

-

Technology upgrades: Lease if you want the latest tech every few years

-

Tax incentives: EV purchase incentives may make buying more attractive

Conclusion

Deciding whether to lease or buy an electric vehicle in 2026 depends on your financial situation, driving habits, and desire for flexibility. Leasing offers lower payments and the latest technology, while buying can save money in the long run and gives full ownership. Evaluate your priorities and make a choice that fits your lifestyle.

FAQ

Q1: Can I buy an EV after leasing it?

A: Yes, many leases offer a buyout option at the end of the term.

Q2: Are there tax benefits for leasing an EV?

A: Leasing may have limited tax benefits compared to buying, which often qualifies for federal and state incentives.

Q3: How long does an EV typically last?

A: Modern EVs can last 8-15 years with proper maintenance, depending on battery care.

Q4: Is leasing cheaper than buying in the long run?

A: Leasing usually has lower short-term costs, but buying may be more cost-effective over many years.

Q5: Do I need to worry about battery replacement?

A: Most EV warranties cover batteries for 8-10 years, minimizing replacement concerns.